Tracking Family Finances

Starting a family is a big responsibility! But, you don’t need me to tell you that! There are so many changes you go through when adding a new family member. Not only do you learn how to feed, clothe, and care for a new child (or husband! 😀 ), you also have to figure out how you are going to finance it all! Babies aren’t cheap, and they don’t pay their own way.

As parents, my husband and I want to make sure that we are financially prepared as our family is growing. We don’t want to have to worry about whether or not we will be able to pay our utilities or buy food. And going a step further, we want to be able to give our children learning experiences that go along with being involved in clubs, groups, activities, and vacations.

All of these things take money, and in order to make sure we have enough to live and then do the fun things, we have to know where our money is being spent! It floors me whenever I hear someone mention that they don’t balance their checkbook. HOW DO YOU NOT BALANCE YOUR CHECKBOOK?!?!?! If you don’t take the time to do do this simple task, you don’t know how much money you have let alone where your money is going! These are huge problems that can cause you to overdraft or write a bad check. If you don’t know where your money is going, it could be slipping away from you without you even knowing it. Your family finances could crash! You could be overspending on small unnecessary expenses more than you realize. (Think coffee! Or in my case, Sonic drinks!)

Using Excel To Track Family Finances

To track our family’s finances, I use a budget sheet in the form of an Excel document. There are other programs out there as well, but I started using Excel when I was in college because I had an assignment to create a budget spreadsheet for one of my computer classes. Since then, it has grown into what it is today. I could NOT live without it! It has been a lifesaver when tracking what we are spending our money on and what our net income is each month.

Check Register

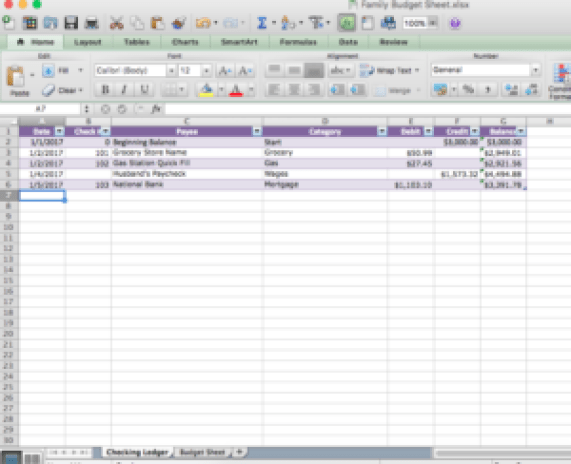

There are two parts to our budget sheet. The first is a regular checkbook register that we fill out throughout the month. It consists of your standard columns: date, check number, payee, debit, credit, and balance. However, I also included a category column. In this column, I label each transaction with a descriptive word or phrase that tells me what we spent money on. Gas, food, utilities, clothing, medical, and car payment, are a few of my categories.

If I have a transaction that covers multiple categories, I pick the category that most of the items fall under. For example, if I go to Walmart, I might by groceries, but I also could throw an outfit for Mia in my cart as well. I would just put this under food because I don’t want to take the time to go through each individual receipt and split it up. If I felt that a certain category was being underrepresented or another overrepresented, I would take the time to be more specific.

Excel Budget Sheet

The second part of our budget sheet is an income and expense sheet. At the end of each month (and sometimes in the middle) I take all the transactions in each category and total them up. I insert them into the second sheet and Excel then adds all the income and expenses. The expenses are subtracted out and our net income is at the bottom. I also total our accounts at the bottom to double check that I entered all the numbers correctly.

Our budget sheet really helps lay out our family finances and allows us to see where our money is spent. I can tell if we spent too much money on food or clothing in a specific month. When I fill out this sheet in the middle of the month, I can determine if we need to refrain from going out to eat in the next couple of weeks or if it is okay to treat ourselves a little! There is also an average calculator on the far righthand side so that we can see about how much we spend each month on expenses that fluctuate, such as the water bill, groceries, or gas. This helps us plan for future months and set a hard budget if need be.

Tracking our family finances this way has helped us pay off student loans and vehicles faster than we could have hoped! It is also helping us save for a down payment on a house, vacations, and Mia’s college fund. This method really works for us and I am providing the file for you to download if you want to try it!

Click Here to Download: Family Budget Sheet

However, while this way might not work for everyone, the point is that every family needs to be doing SOMETHING! Some people need to place cash into envelopes so they are limited to only spending a certain amount. Some families are better off with an app that you can do an envelope system on, which can go on multiple family member’s phones. There are so many options, so get out there are do something!

Comment and Subscribe

What methods have helped you keep track of family finances? If you use an app, which one do you use? There are so many different options out there it is sometimes hard to muddle through it all! I am always open to new ideas and there is always room for improvement! Leave me a comment!

As always, if you would like to make sure you never miss one of my oh so interesting posts, please subscribe by email at the top or bottom of this page. Happy planning!

SaveSaveSaveSave